- Featured Listings

- Our Communities

- Adult Active in Anthem

- Adult Active in Avondale

- Adult Active in Buckeye

- Adult Active in Cave Creek

- Adult Active in Chandler

- Adult Active in Fountain Hills

- Adult Active in Gilbert

- Adult Active in Glendale

- Adult Active in Goodyear

- Adult Active in Litchfield Park

- Adult Active in Mesa

- Adult Active in Paradise Valley

- Adult Active in Phoenix

- Adult Active in Queen Creek

- Adult Active in San Tan Valley

- Adult Active in Scottsdale

- Adult Active in Sun City

- Adult Active in Surprise

- Adult Active in Tempe

- Buyers

- Sellers

- Data

- Monthly Housing Report

- Monthly Rental Report

- Anthem Real Estate Market Statistics

- Avondale Real Estate Market Statistics

- Buckeye Real Estate Market Statistics

- Cave Creek Real Estate Market Statistics

- Chandler Real Estate Market Statistics

- Fountain Hills Real Estate Market Statistics

- Gilbert Real Estate Market Statistics

- Glendale Real Estate Market Statistics

- Goodyear Real Estate Market Statistics

- Litchfield Park Real Estate Market Statistics

- Queen Creek Real Estate Market Statistics

- Paradise Valley Real Estate Market Statistics

- Phoenix Real Estate Market Statistics

- Scottsdale Real Estate Market Statistics

- Surprise Real Estate Market Statistics

- Tempe Real Estate Market Statistics

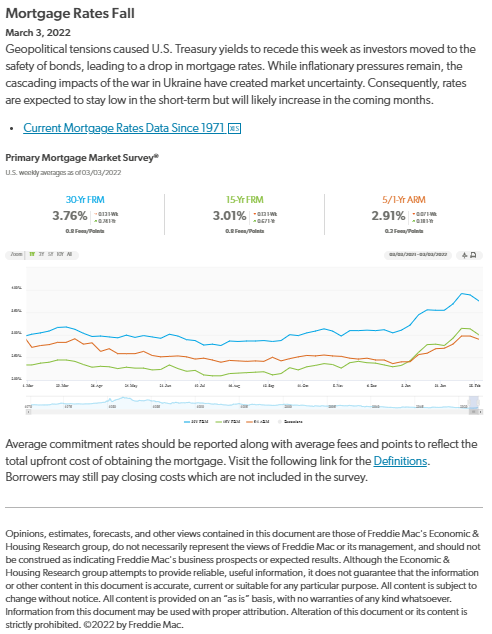

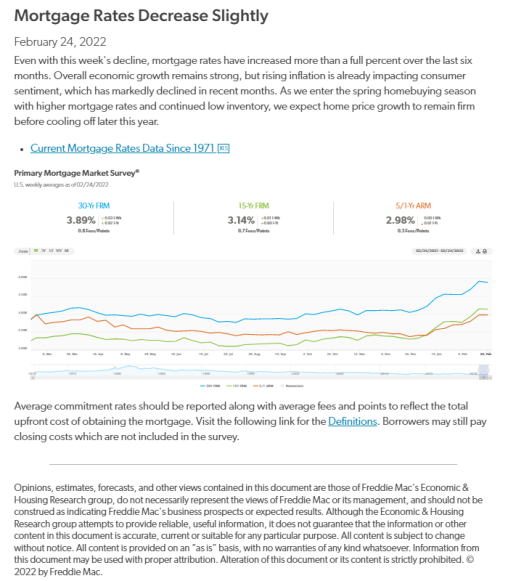

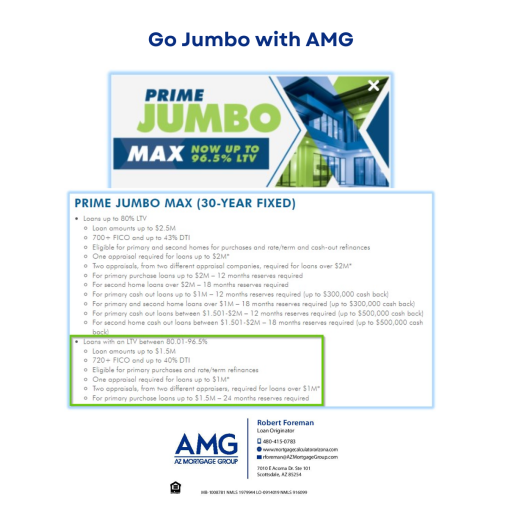

- Mortgage

Dianne does Real Estate; Robert does Mortgages and Real Estate.

Together, they make an amazing team. Call or message us anytime to learn how we work.

Dianne Keck

Mobile: (602) 702-0953

Email: dianneekeck@gmail.com

Robert Foreman

Mobile: (480) 415-0783

Email: robert@livinginpheonix.net

HomeSmart Terravita

33725 N Scottsdale Rd Suite 130

Scottsdale, AZ 85267