| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

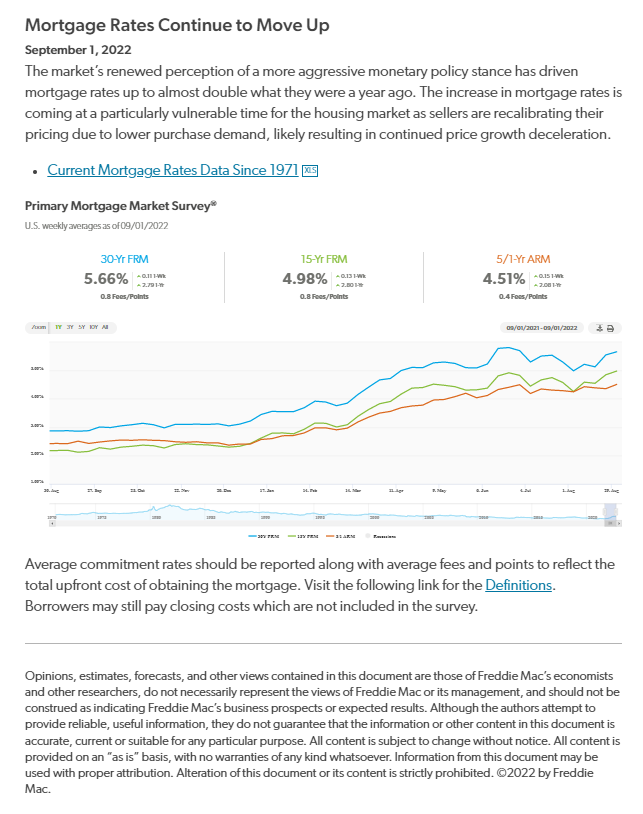

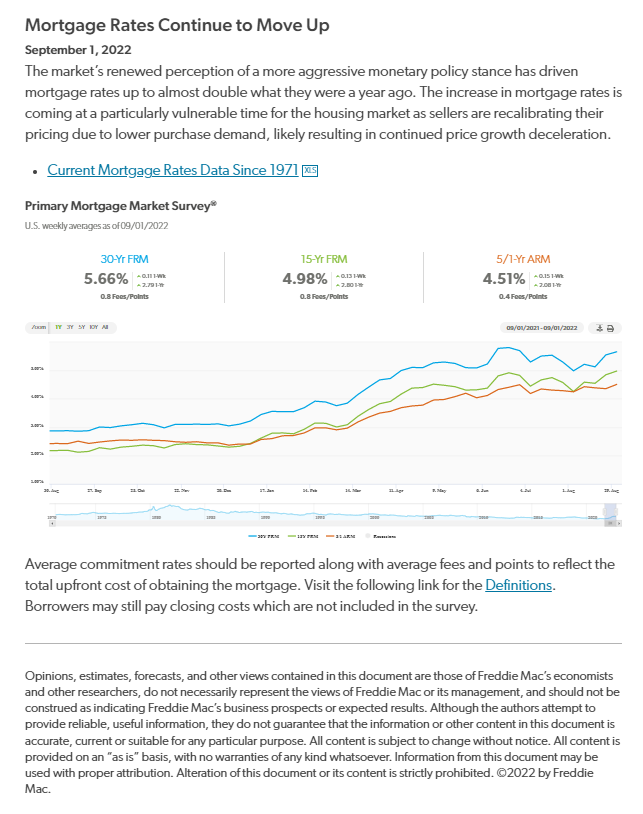

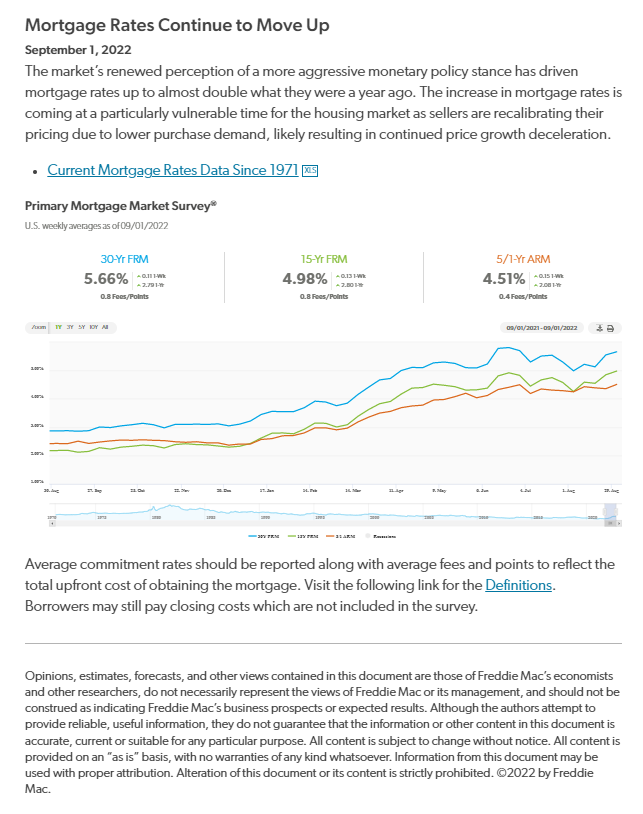

Freddie Mac (9/8/2022):

“Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation. Not only are mortgage rates rising but the dispersion of rates has increased, suggesting that borrowers can meaningfully benefit from shopping around for a better rate. Our research indicates that borrowers could save an average of $1,500 over the life of a loan by getting one additional rate quote and an average of about $3,000 if they get five quotes.”

US credit card debt and annual percentage rates are near all-time highs.

Inflation hit a 40-year high (again) in July.

Meanwhile, the personal savings rate in the US just hit its lowest level since the Great Recession.

Why wait for worsening rates or economic conditions?

Take advantage of your home’s historic appreciation while you can.

How do you combat inflation?

DEBT CONSOLIDATION – CALL ME TODAY TO GET STARTED.

What can you do with your Home Equity?

Pay off Student Loans

Consolidate Debt

Home Improvements

Lower Your Rate And/Or Term

Eliminate Mortgage Insurance

Free Up Money To Invest

Buy Another Home

Your loan may qualify for an Appraisal Waiver.

Call or message me today to discuss options.

I am your One-Stop for Real Estate and Mortgages.

Schedule a Free Consultation:

https://lnkd.in/dSyx2JC

What’s Your Home Worth?

Download an Instant Estimate at ArizonaHouseValues.net

Need a Mortgage?

Apply Online at

https://lnkd.in/g2busXE

Search Phoenix Listings at

https://lnkd.in/gkmWvvm

Source: Freddie Mac: https://www.freddiemac.com/pmms

#arizona #arizonarealestate #arizonarealtor #arizonaliving #phoenix #phoenixrealestate #phoenixaz #phoenixarizona #phoenixrealtor #phoenixrealestateagent #phoenixhomes #phoenixforyou #mortgagetips #mortgagerates #mortgagelender #mortgagerates #mortgages #realestatemarket #realestatebroker #realestate #realestateblog #brokersarebetter #valoans #conventionalloans #fhaloan #jumboloans #mortgage #luxury